In my work as a Certified Divorce Financial Analyst™, I will sometimes be given my client’s spouse’s Financial Affidavit for review. Today I was looking over a Financial Affidavit used in my county and was reminded of the difference in the depth of information and subsequently the analysis that I perform when I do my financial analysis versus what you will get when only Financial Affidavits are used. (Note: Financial Affidavits are called different things in different states. For example, in New Jersey, it’s called a “Case Information Statement (CIS)”, in Utah it’s a “Financial Declaration”, and in New York it’s called a “Statement of Net Worth.”)

For instance, my fillable form where clients list out their budget items is far more inclusive, and it serves as a reminder of all those expenses that people tend to forget about, like lawn and snow removal service, annual termite service, annual car registration fees, summer camp, and paying your CPA every year. These are just a few examples that can add up and have a big effect when you are depending on support. If you don’t ask for an expense to be covered, it won’t be!

While a Financial Affidavit will ask for actual and anticipated expenses, it doesn’t allow for an examination of changing expenses through the years. Expenses are not static and negotiations can be made based on realistic projections about how expenses will change. For instance, a couple might know that car payments on the husband’s car will end in 3 years or that the wife’s car is about to die and that she will need a new one. The wife might want to buy her own home but might need a couple of years of support payments before she can qualify for a loan and make that purchase. One child might be headed for college next year, and support payments will end but college related tuition or support will start. All these things can be addressed in my software, where individual expenses can be started or stopped in any given year, up to 20 years out. My clients don’t just see anticipated expenses in one snap shot, because that is not real life.

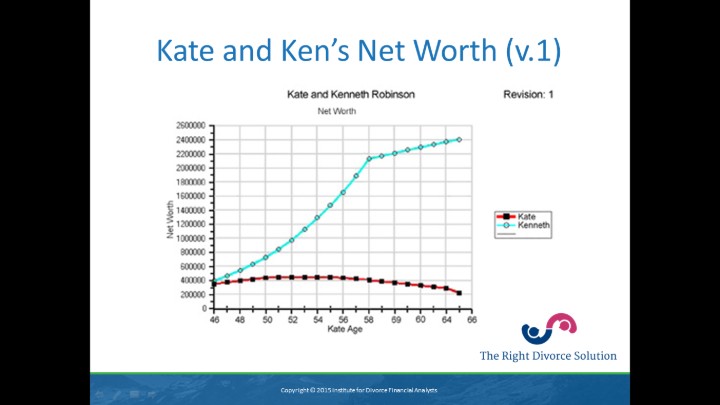

A final example is how I examine how income and expenses will affect the long term net worth of both spouses. My analysis might show that based on a given settlement proposal, one spouse may have to dip into his or her half of assets to make ends meet and his or her net worth and capital will decline rather than increase. (See the graph pictured with this article for an example). This is incredibly enlightening, particularly in long term marriages, and makes negotiations easier when one spouse will clearly have far more net worth at retirement than the other.

These are just a few examples, but they apply to the majority of the cases I handle. Many of my clients have been in long term (20 plus year) marriages, are over 50 and cannot afford to make financial mistakes in their divorce. Using a CDFA in settlement negotiations as either an advocate or as a financial neutral and mediator is a necessity if you want to thoroughly understand the financial effect of your divorce.